The Only Guide for Thomas Insurance Advisors

Wiki Article

The Greatest Guide To Thomas Insurance Advisors

Table of ContentsFascination About Thomas Insurance AdvisorsThomas Insurance Advisors Fundamentals ExplainedThe Facts About Thomas Insurance Advisors RevealedThe 7-Second Trick For Thomas Insurance Advisors

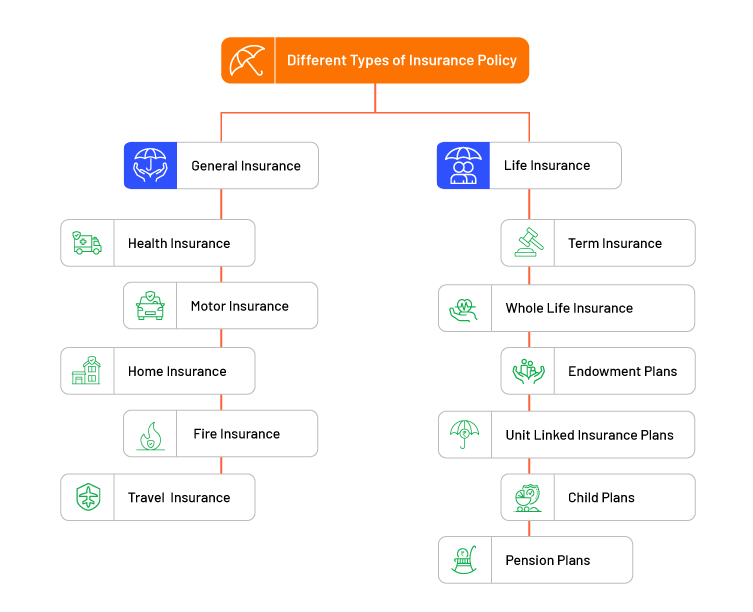

We can not stop the unexpected from happening, however often we can safeguard ourselves as well as our households from the worst of the economic after effects. Selecting the right kind and amount of insurance policy is based on your details circumstance, such as youngsters, age, way of life, as well as work benefits - https://www.taringa.net/jstinsurance1/insurance-in-toccoa-ga-thomas-insurance-advisors-leading-the-way_59ch99. Four types of insurance that most economists advise consist of life, health and wellness, auto, and also lasting special needs.Wellness insurance coverage protects you from tragic expenses in case of a severe mishap or ailment. Long-term impairment safeguards you from an unanticipated loss of income. Auto insurance coverage avoids you from birthing the monetary worry of a pricey crash. The 2 basic kinds of life insurance policy are traditional entire life and term life.

It consists of a fatality benefit and likewise a cash worth component.

4 Simple Techniques For Thomas Insurance Advisors

9% of married-couple families in 2022. They would certainly be likely to experience economic difficulty as a result of one of their wage income earners' deaths., or exclusive insurance coverage you purchase for yourself and also your family members by contacting health insurance coverage companies straight or going via a wellness insurance coverage agent.

If your earnings is reduced, you may be one of the 80 million Americans who are eligible for Medicaid.

According to the Social Safety and security Administration, one in 4 employees entering the workforce will end up being disabled before they get to the age of retired life. Automobile Insurance in Toccoa, GA. While health insurance coverage pays for hospitalization and medical costs, you are typically burdened with all of the expenditures that your paycheck had actually covered.

Everything about Thomas Insurance Advisors

This would be the very best option for safeguarding budget friendly disability coverage. If your company doesn't offer long-term protection, right here are some points to think about prior to acquiring insurance coverage by yourself: A policy that ensures income replacement is optimal. Several plans pay 40% to 70% of your income. The expense of disability insurance policy is based on several elements, consisting of age, way of living, as well as health and wellness.Before you purchase, check out the small print. Several strategies call for a three-month waiting period prior to the protection starts, give a maximum of 3 years' well worth of protection, as well as have check out this site substantial plan exclusions. Automobile Insurance in Toccoa, GA. Despite years of renovations in auto safety and security, an approximated 31,785 people passed away in website traffic crashes on U.S.

Mostly all states call for drivers to have car insurance and minority that do not still hold motorists financially responsible for any damage or injuries they create. Right here are your alternatives when acquiring cars and truck insurance coverage: Responsibility protection: Spends for building damage as well as injuries you create to others if you're at fault for an accident as well as also covers litigation costs and judgments or negotiations if you're taken legal action against due to an automobile crash.

Comprehensive insurance policy covers burglary as well as damages to your cars and truck due to floodings, hail, fire, vandalism, dropping objects, and also pet strikes. When you finance your car or rent a car, this kind of insurance policy is required. Uninsured/underinsured driver () insurance coverage: If an uninsured or underinsured motorist strikes your car, this insurance coverage pays for you as well as your passenger's medical expenditures and might also represent lost revenue or make up for discomfort and also suffering.

Thomas Insurance Advisors Things To Know Before You Get This

Clinical repayment insurance coverage: Med, Pay insurance coverage assists spend for clinical expenses, typically in between $1,000 as well as $5,000 for you and your guests if you're wounded in a crash. Just like all insurance coverage, your conditions will identify the expense. Contrast numerous rate quotes as well as the coverage offered, as well as inspect occasionally to see if you qualify for a reduced price based upon your age, driving record, or the location where you live.Employer insurance coverage is frequently the very best alternative, however if that is not available, acquire quotes from numerous carriers as many give price cuts if you acquire greater than one sort of insurance coverage.

There are several different insurance plans, and also recognizing which is appropriate for you can be challenging. This guide will certainly review the different types of insurance and what they cover.

Depending upon the plan, it can likewise cover oral and vision treatment. When choosing a wellness insurance plan, you have to consider your specific needs as well as the degree of protection you require. Life insurance policy is a policy that pays a sum to your beneficiaries when you pass away. It gives financial safety for your enjoyed ones if you can not support them.

Report this wiki page